|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Loan to Buy a House: A Comprehensive Guide for HomebuyersUnderstanding Home LoansBuying a house is a significant milestone, and understanding the types of loans available can help you make informed decisions. A home loan, or mortgage, is a specific type of loan that enables you to purchase real estate. Types of Home Loans

The Loan Application ProcessApplying for a home loan involves several steps, from preparing your finances to finalizing the loan. Steps to Apply for a Loan

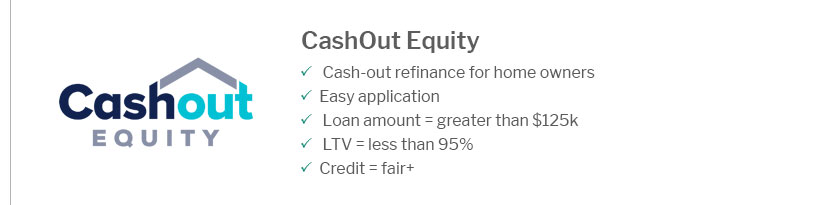

Once approved, you can move forward with your home purchase, using the loan to finance the majority of the cost. Factors Affecting Your LoanVarious factors can influence your home loan's terms and interest rates. Interest RatesInterest rates can significantly affect your monthly payments and the total cost of your loan. It's crucial to stay informed about current rates, such as the 10 year mortgage rates, to make the best decision. Down PaymentThe size of your down payment can impact your loan. A larger down payment can reduce your loan amount and potentially lower your interest rate. FAQWhat is a mortgage pre-approval?A mortgage pre-approval is a conditional commitment from a lender that estimates how much you can borrow, based on a review of your financial information. It helps show sellers you're a serious buyer. How much should I save for a down payment?The typical down payment is 20% of the home's purchase price, but many loans allow for lower down payments. It's important to consider how different down payment sizes can affect your loan terms. Can I get a home loan with bad credit?Yes, you can still get a home loan with bad credit, though it may come with higher interest rates and stricter terms. Government-backed loans might be a viable option for those with lower credit scores. https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-guaranteed-loan-program

USDA Section 502 Guaranteed Loan funds may be used for: New or existing residential property to be used as a permanent residence. Structures can be detached, ... https://www.investopedia.com/articles/mortgages-real-estate/08/homebuyer-financing-option.asp

Various financing options are available to first-time homebuyersincluding conventional mortgages and government-backed loans from the Federal Housing ... https://www.rocketmortgage.com/learn/best-loan-for-buying-a-house

You can utilize your home's equity using a reverse mortgage, home equity loan or HELOC. Take a look at our guide to learn about the pros and cons of each.

|

|---|